Financial Planning and Budgeting

Management Consultancy Services

“If you fail to plan, you plan to fail.”

Planning in business serves to be an essential task in order to figure out the path to be followed. A business entity stands on certain core pillars. One such strong pillar turns out to be Finance. It can be regarded as the lifeline of any business that uplifts an organization. Be it company formation,expansion, dealing with any project, employee hiring etc. finance is required in every step. Proper planning and management of finance turns out to be one of the most important tasks for any organization regardless of its size and nature. Many a times, the terms financial planning and budgeting are considered to be the same, but in reality, there exists a difference.If you are a business owner, then this is all you need to know about financial planning and budgeting.

What is Financial Planning and Budgeting?

A framework, comprehensive evaluation that explains the proper utilization and implementation of finance in different business domains for its future growth and development is referred to as financial planning. In simple words, we can say that financial planning is a definite task that determines how a business entity will achieve its strategic goals. It is important to start at an initial stage because established companies, over a course of time, might have to undergo financial restructuring. Let’s have a glance at the benefits that you will be able to derive by implementing a financial plan. A financial plan helps in:

- Better management of finance

- Gives a holistic view of the business

- Create integrated strategies and interconnect them with financial growth

When it comes to financial budgeting, it looks into the matters of allocation of funds for a shorter duration. A financial budget is a financial plan for a specific period, generally a year. It generally focuses on the budget surplus or deficit at the end of the period.

Now, let’s have a look at the different types of Financial Planning and Budgeting.

Types of Financial Planning

Cash Flow Management

Cash-Flow gives insight regarding the inflow and outflow of cash while carrying out the business activities. This helps to keep a track on the cash-flow activities and change them accordingly if required.

Investment Management

This turns out to be another type of financial planning. Investments are meant to grow your money over a period of time. This includes investment in various domains like bonds, mutual funds, forex etc. It can be seen that investment management can help you uplift your financial scenario.

Insurance Planning

Insurance turns out to be another type of financial planning that is meant to cover unforeseen situations. Failing to plan for insurance can affect your financial planning to a great extent.

Tax Planning

Tax is one domain that no business can avoid. It becomes a mandate to pay corporate and individual taxes depending on the profits earned. Tax planning is another area where you need to look into when it comes into financial planning.

Real Estate Planning

Wealth creation can increase your financial position. Asset creation turns out to be an extremely important option with low risk and high investment return.

Types of Financial Budgeting

1. Zero-Based Budgeting

In this type, the baseline is considered as zero instead of previous year’s budget. The benefit of opting for zero-based budgeting is that it is cost-friendly but then involves huge documentation process.

2. Top-Down Budgeting

Here, the budget plan is prepared by the top officials which need to be followed by the lower level of management.

3. Bottom-Up Budgeting

This is the exact reverse of the earlier one. Here, the inputs are fetched from the lower-management and are considered while preparing the budget by the top management.

4. Activity-Based Budgeting

Here, the budget is prepared according to the organizational activities. Now, let’s get down to the process.

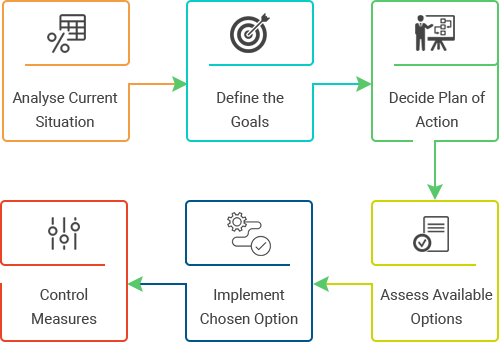

The Financial Planning Process

In order to initiate the financial planning process, you need to take the below-mention steps accordingly:

By now, you have got an idea about what financial planning and budgeting is all about, and how important it is for business entities. Now, dealing with such a tedious job gives birth to a lot of complexities. Minor errors in the financial statement can lead a business entity into big trouble. To avoid so, it is recommended to outsource the financial plan and budget to a professional expert who can help you in making the process easy. To have better clarity, do read the following points to know as to how an expert can help you.

Benefits of Availing for Financial Planning and Budgeting Services

Widens Business Scope

Business experts are well-versed with the market scenario and can provide you with the industry insights contributing to the expansion of your business growth. New ideas can be fetched from the information provided and you can work on improvising your business from several aspects.

Minimize Errors

The experts handle business professionally which demands their reports to be error-free. Your helping hand can help you to prepare financial plans error-free that eases the implementation process to a great extent.

Streamline the Plans

While dealing with financial planning, one has to deal with many plans that might be implemented in the present as well as the future. These plans need to be prioritized so that the immediate tasks can be completed at an urgent basis followed by the later ones to carry out the business functions effectively and increase the business growth.

Better Risk Management

Professionals are experts when it comes to analyzing the business risk. By availing the service from business experts, you will reduce the business risk and at the same time, the existing risk will be solved efficiently.

Saves Training Cost

Financial planning and budgeting decisions help you to analyze the routes for savings. By availing the financial planning service from a professional, it would save the training cost that you need to occur if you want to carry out the process in-house by training your available resources.

Address Budget

Having a financial plan helps you to address the required budget accordingly that needs to be fixed on different business aspects. The business budget needs to be distributed effectively so that each department of your organization can work efficiently and carry out the business operations smoothly.

Routes of Savings

The financial planning process helps you to pave out more pathways for savings and revenue generation, focusing on the best possible ways to minimize unwanted expenses. Availing the financial planning services helps your business to identify new routes of profit generation and in -return the business savings gets levelled up which can be used for future expansion.

Wondering whom to contact? Don’t worry. Your financial guide is just below.

Alriyadah | Your Financial Guide

Alriyadah, since its inception, has been one of the top financial advisors in UAE. We are a team of experts who provide financial assistance to our clients ranging from Accounting, Taxation, Financial planning, VAT, Audit services etc. Our financial experts will understand your business, provide financial advice, and cater to your needs accordingly. To have a word, do contact us today – we’d be glad to assist.